Table of Content

You may receive multiple checks for a single claim, or checks might go out to different people, depending on the incident and your insurer. When it comes to settling your claim, not all providers are equal. As you can tell from this list of homeowners insurance claims ratings, it's important to know how your company stacks up.

Making this a yearly routine can ensure that you keep your premiums as low as possible. If your insurer approves your claim, you will receive a check or payment via direct deposit. If it is a major claim that requires lots of rebuilding your payment may be sent out in installments as the work is completed. In other cases, your insurer may send out an advance check against the final settlement amount to give you some funds while waiting for the claim to be completed. It is also possible that you will receive separate checks for the structure of your home and your personal possessions. Depending on the severity of the damage and your insurance company, a claims adjuster may be sent out to inspect the damage.

How do I file a homeowners insurance claim?

With Credible, you can easily compare homeowners insurance rates from top carriers. For current loans, we'll release the amount that exceeds your unpaid balance in addition to the first disbursement of insurance claim funds. We’ll mail your initial disbursement check within three business days of processing your insurance claim check. Barry advises that homeowners who are having trouble accessing insurance funds go directly to their mortgage lender rather than to their insurance company. "It's better if you tell them what happened rather than them hearing it from the insurance company."

See our current mortgage rates, low down payment options, and jumbo mortgage loans. Unfortunately for some homeowners, your mortgage company can hold your check. If a borrower listed as a payee can’t sign the insurance check, call us for information about the documentation we’ll need to proceed. It is also a good idea to have a contractor on site when the claims adjuster arrives. They will know if the adjuster is making an accurate assessment of the repair costs. Next, you will need to contact your provider to let them know you need to file a claim.

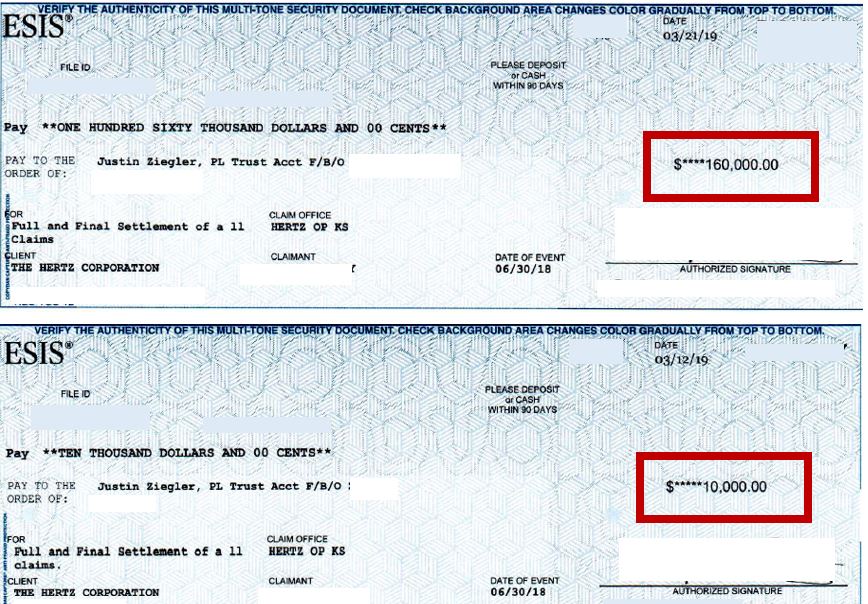

What happens when you need to issue multiple claim checks?

Login for quick access to your previous policy, where all of your vehicle information is saved. Access your policy online to pay a bill, make a change, or just get some information. Check on repair progress regularly and arrange to be present when your lender inspects the work. If issues are identified, agree on an approach and timeline for their resolution, then attend any subsequent inspections.

This is so the lender (and/or, in the case of a coop or condo, the overall building), who has a financial interest in your property, can ensure that the necessary repairs are made. When you have a home insurance claim, the check may be made out to several persons, or it may be made to you as the house owner or named insured on the policy. Your insurer will want you to make temporary repairs if they can be done safely, this will help prevent further damage from happening. If you must purchase supplies such as tarps, wood etc. to make the repairs be sure to keep the receipts as your insurer may reimburse you. It’s also possible that your mortgage lender will require an inspection to make sure the repair work was completed correctly. It’s possible you won’t agree with the claims adjuster’s settlement amount.

In a home insurance claim, who receives the claim payment?

Lender may disburse proceeds for the repairs and restoration in a single payment or in a series of progress payments as the work is completed. No matter how significant your property damage — even with a complete loss of your home — we’ll work with you to review all of your options. If you’re still having financial difficulty at the end of the disaster assistance, we’ll discuss how to complete a confidential review of the options to help with payment challenges. Clearsurance is dedicated to helping customers save on insurance. US Insurance Agents works hard to provide our users with a fast and simple way to get and compare insurance rates for multiple lines of insurance. In the end, the decision of whether to keep the money is up to you.

When both the structure of your home and your personal belongings are damaged, you generally receive two separate checks from your insurance company, one for each category of damage. If your home is uninhabitable, you'll also receive a check for the additional living expenses you incur if you can’t live in your home while it is being repaired. If you have flood insurance and experienced flood damage, that means a separate check as well. Figuring out insurance claims payments and managing your claims checks can be complicated, here's what to expect. With a major claim it is possible that your mortgage lender will put the check in an escrow account and pay the contractor as the work is completed. You will have to work with your mortgage lender and your contractor to have funds released and in many cases your lender may inspect the home before final payment is issued.

Homeowners Insurance Claim Check 101

The rules for filing a claim may differ depending on your insurance company and the state you live in. But there are some home insurance claims mistakes you need to avoid. Yes, third-party insurance is all you need to be able to drive legally, but why leave yourself open to massive losses that you know you could have prevented by opting in for better coverage?

The most common home insurance claims are related to weather events – but other claims are more unusual and can be downright bizarre. If you have a replacement cost insurance policy for your personal belongings, you typically must replace the items before your insurance carrier will reimburse you. Your insurer will likely suggest you document the damages and may schedule a claims adjuster to inspect your home.

If you were to file a claim now, you would have suffered a loss of 2 lakhs due to Depreciation. Consider these two scenarios, your vehicle has been stolen or has been damaged so badly that it is declared a write-off. If you do not have the Return to Invoice Cover, you are only eligible to be compensated for the current Insurance Declared Value of your vehicle.

With just a few clicks you can look up the GEICO Insurance Agency partner your Business Owners Policy is with to find policy service options and contact information. Any entity or person who is a named insured on the policy for the damaged property. Each mortgage company has its own procedure, so be sure and find out from yours how it works. When your claim is finished, you will likely receive a notice that shows the total amount paid and that you accept the claim as closed. In most cases, a single claim should not cause your rate to rise, although certain types of claims — such as one for a dog bite — could quickly result in higher rates.

One option, if home damage is not too extensive, is to pay for repairs using a home equity loan, rather than making an insurance claim. This can reduce the chance that your homeowners insurance rates could rise as a result of making too many claims. The home insurance claim process can seem overwhelming, but don't worry, we have got you covered.

"If the borrower is still living in the home and is making progress toward repayment and the investor is okay with it, we will release the insurance benefits so repairs can begin," says Northagen. If there is an outstanding mortgage or home equity loan, the servicer’s name should be listed as a payee. Depending on the complexity and severity of your damage or loss, it could take days or several weeks to get your check. We are not affiliated with any one insurance company and cannot guarantee quotes from any single insurance company. Any company or person mentioned on the insurance as a named insured for the damaged property.

We've looked at all the homeowners insurance claim check questions you are likely to have, and we have the answers. You'll have to submit a list of your damaged belongings to your insurance company . It is to match the remaining claim payment to the exact replacement cost. If you decide not to replace an item, you’ll be paid the actual cash value amount for it. In some cases, an insurance company may issue multiple checks in response to a single claim.

Her writing interests include “How to” guides across different insurance types as well as other educational pieces. Alison earned a BA in Communication and Media from Merrimack College in Massachusetts. Kyra Baker is a fact-checker with nearly 10 years of experience working and assisting on editorial projects within the culture, arts, and publishing spaces. For the past eight years, she has worked as a fact-checker at Art Papers Magazine, an Atlanta, Georgia-based art magazine. She leverages this experience for The Balance, fact checking content for accuracy across a variety of financial topics.

No comments:

Post a Comment