Table of Content

There are a number of possibilities here, and each case is unique. You may find it useful to follow these tips to ensure your insurance claims get paid. Once the claim has been settled, the insurance company will not pay for the same damages again. Each insurance company will have a timeline for when you must claim your loss to be eligible to make your claim.

To compare quotes from many different insurance companies please enter your ZIP code above to use the free quote tool. When work is completed to restore your property, make certain the job has been completed to your satisfaction before you let your insurer make the final payment to the contractor. If your home has been destroyed, the amount of the settlement and who gets it is driven by your policy type, its specific limits and the terms of your mortgage. For example, part of the insurance proceeds may be used to pay off the balance due on the mortgage. And, how the remaining proceeds are spent depend on your own decisions, such as if you want to rebuild on the same lot, in a different location or not rebuild at all.

How the Insurance Claim Check Process Works

Speak to a loan representative and make arrangements for him to inspect the property. If you have already made the repairs using your own money, the lender will agree to endorse the check once it has confirmed that the work is complete. However, if you will be using the funds to repair the property over time, the lender will hold the money in escrow. Like a construction loan, it will disburse funds as needed based on invoices and a proposed draw schedule for the repairs. While it may seem obvious that you will get the home insurance claim check made out to you, that is not always the case.

They do increase your premiums, but the benefits they offer can help you save a lot in the event you have to make an insurance claim. You may qualify for forbearance, but ultimately remain responsible for your loan. If your home has been seriously damaged or destroyed, your insurance company releases a check made out to both you and your mortgage lender to pay for the necessary repairs.

How do I cash a check made out to my mortgage company?

In some cases, your lender may put the money from your insurance provider in an escrow account. In this situation, your lender will pay for work as it’s completed. You’ll likely need to show your mortgage lender your contractor’s bid in order to get upfront funds, and your lender may wish to inspect your home before making the final payment to the contractor.

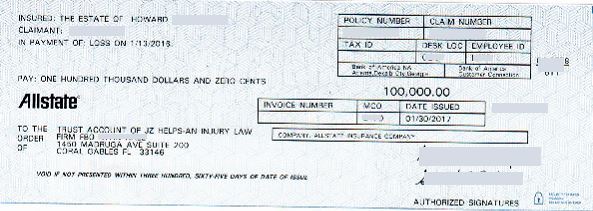

These gaps can be covered by what are called add-ons to your motor vehicle insurance policy. Let's look at three in particular that can benefit you greatly if your vehicle suffers serious damage. Mortgage lenders have an equal right to the insurance check to ensure repairs are made, notes Barry. When you experience damage to your property, you will go through your insurance companys claims process. It is after your claim is approved that you will receive a check made out to you and the lender.

Insurance Claims Process

Perhaps you want to check for fraud, or want to get an understanding of why your premiums are what they are. Luckily, checking your home insurance claim history can be quite straightforward. Your insurance company will ask you to document the damage if it is safe to do so and may also schedule a time for a claims adjuster to inspect the damage. This is why it is very important to always have a completed home inventory checklist updated and safely saved on a computer, iPhone or app. Home insurance companies may also ask for make, model, serial numbers and proof of photos for ownership.

A claims adjuster may need to visit your home to inspect the damage. You may complete a "proof of loss" form at this time, which is a formal statement about the loss. Your insurer will either approve or deny your claim based on the adjuster’s evaluation and your documentation. Keep in mind that you might need to send additional evidence if your insurer denies your claim. You can also hire a public adjuster or an insurance attorney to help prove the legitimacy of your claim. Comprehensive insurance policies are definitely a step up from third-party insurance, but it still does not cover everything.

What Happens When Multiple Claim Checks Need to Be Issued?

Her writing interests include “How to” guides across different insurance types as well as other educational pieces. Alison earned a BA in Communication and Media from Merrimack College in Massachusetts. Kyra Baker is a fact-checker with nearly 10 years of experience working and assisting on editorial projects within the culture, arts, and publishing spaces. For the past eight years, she has worked as a fact-checker at Art Papers Magazine, an Atlanta, Georgia-based art magazine. She leverages this experience for The Balance, fact checking content for accuracy across a variety of financial topics.

After a disaster, you want to get back to normal as soon as possible, and your insurance company wants that too! You may get multiple checks from your insurer as you make temporary repairs, permanent repairs and replace damaged belongings. If your home has recently experienced a fire, flood or burglary, you will want to file a claim with your homeowners insurance company. Once your insurer has approved your claim, you will be sent a claim check to repair the damage. According to the Insurance Information Institute, most states require that you make home insurance claims within one year of your loss.

When it comes to repair work, you will want to get a professional estimate of your own. The first step after an incident is to determine if the damage warrants filing a claim. If a hail storm left you with a small broken window, or some tools were stolen from the garage, you will want to be compensated, but it may not be worth filing a claim. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy.

If you were to file a claim now, you would have suffered a loss of 2 lakhs due to Depreciation. Consider these two scenarios, your vehicle has been stolen or has been damaged so badly that it is declared a write-off. If you do not have the Return to Invoice Cover, you are only eligible to be compensated for the current Insurance Declared Value of your vehicle.

Any complicated situations will extend that timeline, such as errors on the claim or misunderstandings about coverage. Your insurance agent will have a much better idea of how long you can expect your claim to take. Insurance firms must designate mortgage lenders as named insureds to fulfill their contractual duties under the policy. This also means that they may receive building-related claim payouts. Each insurance provider will have a deadline by which you must file your claim to be qualified.

Comprehensive car insurance will not only protect the owner from financial liabilities in the event of damage to a third party but will also cover any damages to their own vehicle. The owner is also protected if their vehicle is stolen or damaged due to natural or man-made disasters. The most significant advantage of comprehensive insurance over third-party insurance is personal accident coverage for the policyholder. Comprehensive insurance does come with higher premiums, but the policy makes up for it in huge monetary benefits in the event of an accident. Once you've read the fine print and determined it is in your best interest to file a claim, get that process started as soon as possible.

No comments:

Post a Comment